10th Period: Chickens Coming Home to Roost

I don’t usually like to say, “I told you so,” but when the shoe fits…

In 2013, Kasich and his legislative allies eliminated the so-called “property tax rollback” in order to pay for his continued tax cuts benefitting the wealthy. When I was at Innovation Ohio, we pointed out how disastrous that would be almost immediately.

The rollback was part of the deal the state struck with local school districts in the 1970s when the income tax was passed. The state agreed to essentially subsidize 12.5% of every dollar passed in property taxes with state income tax revenue. So for every $1 passed, property taxpayers only paid 87.5 cents. However, because Kasich and his allies wanted to keep cutting income taxes and even eliminate those income taxes, he eliminated the rollback for all future property tax levies.

So while Ohioans had $8.4 billion in property taxes levied against them in 2012, that number has jumped by more than 1/3 to $11.5 billion. And the rollback now represents 15.7% of the taxes charged, whereas the rollback constituted 20.7% of the property taxes charged in 2012.

Now that the state is offsetting about 25% less than it did 11 years ago, what’s that meant? An even greater burden on local property taxpayers. Wait, wasn’t that burden found to be unconstitutional four different times? Yes. Yes it was.

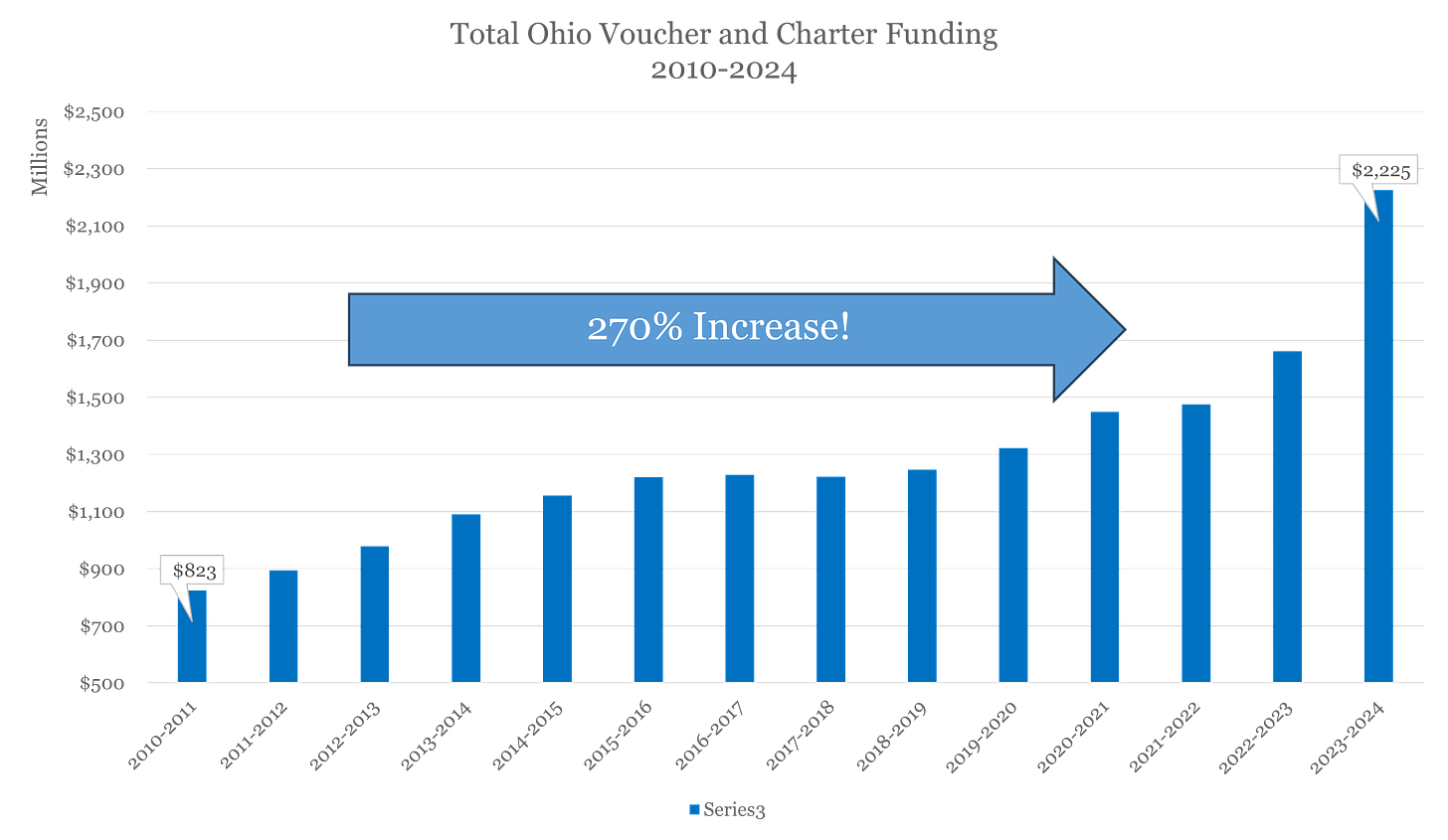

In addition, the state has skyrocketed investment in privately run charter schools and publicly subsidized, private school tuition subsidies.

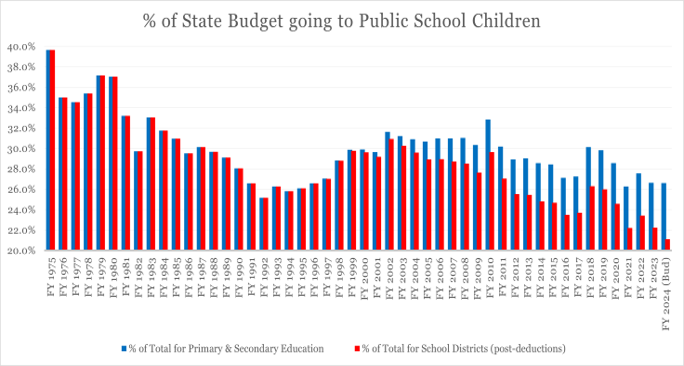

Which has necessarily meant that state funding for local public schools now represents the lowest share of the overall state budget ever, further forcing school districts to ask local property taxpayers to make up for the state’s delinquency.

So when you get your property tax bills and you see those huge increases and start wanting to blame people, turn your gaze toward your statehouse. Because that’s who’s forcing you to make a horrible choice: keep increasing your own taxes to properly fund your schools or watch your kids attend classes with 40-50 students in them, pay for extracurriculars, and lose AP and other college-prep opportunities.

And what’s the public policy payoff for all that? Rich people don’t have to pay income taxes, schools that have never been up to snuff get more per pupil funding than 90 percent of Ohio’s public school students and rich families get to have their private tuitions subsidized by you.

This blog post has been shared by permission from the author.

Readers wishing to comment on the content are encouraged to do so via the link to the original post.

Find the original post here:

The views expressed by the blogger are not necessarily those of NEPC.